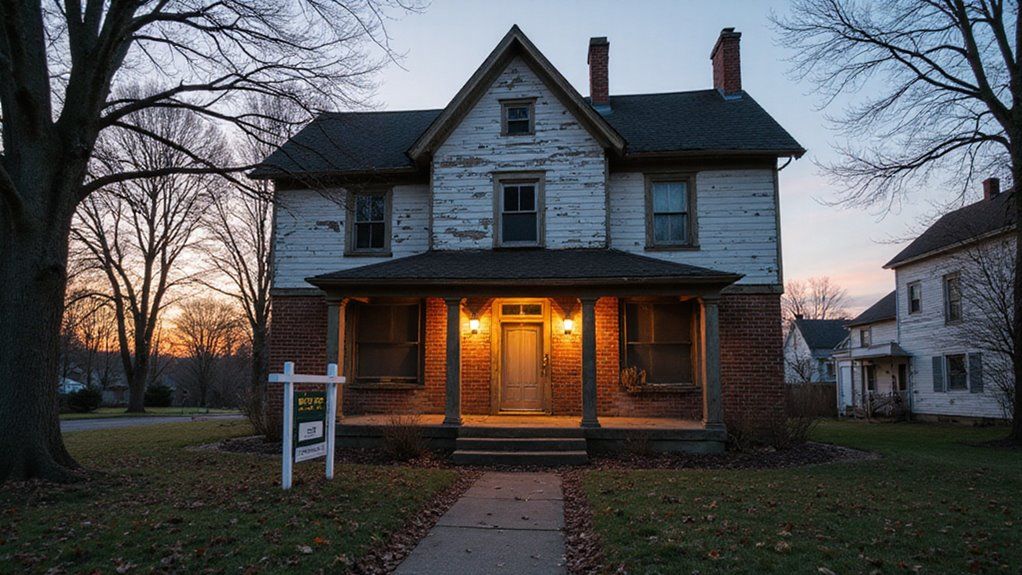

Sell Your House Fast With Foundation Issues in Pennsylvania

Crumbling foundations leave Pennsylvania homeowners trapped in a structural nightmare. Repair estimates spiral into thousands while buyers walk away, leaving families stuck in deteriorating properties they can’t afford to fix. Fortunately, specialized cash buyers offer a lifeline for selling foundation-damaged homes quickly and hassle-free.

You can sell your Pennsylvania house with foundation issues fast by finding cash buyers who purchase properties as-is. These investors specialize in distressed homes and can close quickly without requiring expensive repairs or traditional financing approval. Foundation problems typically reduce home values by 10-15%, but the right buyer eliminates this concern.

In this blog I will explore everything about selling foundation-damaged Pennsylvania homes without repairs.

What Are Foundation Issues in Pennsylvania Homes?

Foundation issues in Pennsylvania homes show up as stairstep cracks, bowing walls, uneven floors, and sticking doors or windows—all clear signs you’ll need to address before selling.

These problems typically stem from the state’s high rainfall, expansive clay soils, and freeze-thaw cycles that cause soil movement and structural stress.

Understanding what you’re dealing with helps you make informed decisions about repairs, disclosure requirements, and your fastest path to closing.

Common Types of Foundation Problems in Pennsylvania

Pennsylvania homes typically experience five major foundation issues. Stairstep cracks in brick or block walls indicate structural movement. Bowing or leaning foundation walls suggest soil pressure problems.

Uneven floors point to settlement beneath the house. Doors and windows that stick often signal foundation shifts. Water intrusion in basements reveals drainage failures.

These problems mainly result from Pennsylvania’s challenging conditions. Expansive clay soils push against foundations with moisture changes. Harsh freeze-thaw cycles create movement in foundation materials.

Heavy rainfall adds pressure when drainage is inadequate. For homeowners planning to sell, proper identification matters greatly. Understanding your specific issue helps with accurate disclosure to potential buyers.

Most importantly, transparency about foundation problems builds trust with serious buyers. This approach leads to fairer negotiations and fewer surprises during inspections.

Signs of Foundation Damage to Watch For

Foundation damage reveals itself through several common indicators. Watch for doors and windows that stick or won’t close properly. Uneven or sloping floors throughout your home signal potential foundation issues.

Gaps between walls and ceilings often indicate settlement problems that need attention. Physical changes to your basement walls require immediate inspection.

Bowing or bulging walls suggest serious structural concerns. Water intrusion or dampness in basement areas typically points to foundation cracks or drainage issues.

Additionally, these problems must be disclosed during home sales. Addressing foundation concerns before listing your property builds buyer confidence. Most foundation issues can be repaired by professionals. Transparency about structural repairs increases trust during negotiations.

How Foundation Problems Develop in Pennsylvania’s Climate

Pennsylvania’s climate causes foundation issues through moisture and temperature changes. Freeze-thaw cycles create soil movement that leads to foundation cracks and shifting.

Heavy rainfall makes clay soils expand by up to 15%, causing wall bowing and structural stress. Areas with poor drainage suffer from water pooling around foundations. This excess moisture erodes soil support and causes settling over time.

Furthermore, seasonal changes amplify these problems. Winter brings frozen ground that pushes against foundations. Spring thaws release this pressure suddenly. Professional foundation inspections can identify early warning signs before major damage occurs.

How Do Foundation Problems Impact Your Home’s Value?

Foundation problems can slash your home’s value by 10–15% immediately, and buyers often demand another 20–30% off during negotiations.

Pennsylvania law requires you to disclose all known foundation defects on the Seller’s Property Disclosure Statement, which directly affects how buyers perceive and price your property.

You’ll face significant negotiation challenges since over 60% of buyers reject homes with foundation issues outright, and 85% won’t proceed without costly repairs or certifications.

Financial Impact Assessment

Foundation damage significantly reduces your home’s value in Pennsylvania. Expect a 10-15% initial market value drop compared to similar homes without issues.

After inspections, buyers often demand another 20-30% reduction during negotiations. More than 60% of potential buyers will walk away entirely when they discover foundation problems.

Most lenders refuse to approve loans without repairs or proper certification. Approximately 85% of interested buyers will require foundation fixes before closing. These financial realities create substantial challenges when selling.

Furthermore, the repair costs must be weighed against potential sale price recovery. In many cases, addressing major foundation issues beforehand proves more economical than accepting deep discounts.

Disclosure Requirements When Selling

Pennsylvania law requires sellers to reveal all foundation defects before buyers commit to purchase. The state’s Property Disclosure Statement law (68 Pa.C.S. §7304) mandates disclosure of every material defect. This includes cracks, bowing walls, water damage, and settling issues.

Hiding problems can result in fraud lawsuits even after closing. Transparent disclosure protects both parties during sales.

If selling a house “as-is” with foundation problems, proper documentation shows good faith. This approach reduces legal risks while attracting serious buyers. Furthermore, investors often value honesty and can close quickly without repair delays.

Buyer Perception and Negotiation Challenges

Foundation issues create significant financing barriers for most buyers. Lenders typically refuse loans until certified repairs are completed.

Buyers often seek 20-30% price reductions beyond repair costs when foundation problems exist. This request reflects their perception of ongoing risk.

Property values with foundation issues typically drop 10-15% below market value. Home inspectors frequently flag foundation concerns that can terminate promising deals. These inspection reports create leverage for buyers during negotiations.

For sellers facing severe foundation damage, cash buyers may represent the only viable option. These investors understand the renovation process but expect substantial discounts. Their offers provide a quicker exit strategy when repairs aren’t financially feasible.

Sell Your House Fast in Pennsylvania Without Expensive Repairs, Junk Removal, or Cleaning!!

We buy houses for cash in Pennsylvania! We will make you a Fast, Fair, Cash Offer To Buy Your House As-Is. There’s No Obligation To Accept. We are here to take the hassle out of selling your home.

Can You Sell a House With Foundation Problems?

You can legally sell your house with foundation problems in Pennsylvania, but you’re required to disclose all known defects on the Seller’s Property Disclosure Statement to avoid liability for fraud or misrepresentation.

Your selling options depend on the severity of the damage—minor cracks may only need documentation, while major issues like bowing walls typically require engineered repairs or significant price reductions.

Understanding Pennsylvania’s disclosure laws and your repair-versus-as-is choices will help you close faster and protect yourself from future legal claims.

Legal Considerations in Pennsylvania

Pennsylvania law requires sellers to disclose all known foundation issues. Buyers receive protection through the state’s Seller’s Property Disclosure Statement. You must document all foundation problems honestly to prevent fraud allegations.

Required disclosures include foundation cracks, previous repairs, water problems, and structural safety concerns. According to Pennsylvania statute 68 Pa.C.S. §7304, proper disclosure protects you from future liability. Additionally, you must report any soil movement issues you know about.

Transparency builds buyer trust and speeds up your sale. Honest disclosures demonstrate integrity throughout the transaction. This approach creates a smoother selling experience for everyone involved.

Disclosure Requirements and Liability

You must disclose foundation settlement issues when selling property. This protects you legally and demonstrates ethical responsibility. Proper disclosure includes all engineering reports, repair documentation, and warranty information.

State laws require sellers to reveal known material defects that affect property value. Transparency builds trust with potential buyers. It prevents future lawsuits for misrepresentation or fraud. The disclosure process may seem challenging at first. Nevertheless, honest communication creates smoother transactions.

Failure to disclose settlement issues can result in legal penalties up to three times the repair costs. Buyers appreciate forthright information about property conditions. This approach allows them to make informed decisions based on facts.

Options for Different Severity Levels

Match your selling approach to your foundation damage level. Minor cosmetic cracks need modest price adjustments for traditional sales.

Moderate issues require professional assessments before listing. Severe structural damage makes cash buyers your most practical option.

Choose your strategy based on damage type: Minor cracks: Repair, disclose, sell traditionally Moderate bowing: Get engineering reports, reduce price 10–15% Severe settling: Target investors buying as-is Active water intrusion: Address drainage before listing Documented failures: Provide repair history, consider cash offers As a result, your disclosure protects buyers while expediting resolution.

Why Sell Your House As-Is to Cash Buyers?

Selling your foundation-damaged house as-is to cash buyers eliminates the hassle of costly repairs and lengthy inspections while putting money in your pocket faster.

You’ll close in days instead of months, skip realtor commissions entirely, and avoid the uncertainty of traditional buyers who typically walk away from foundation issues.

Cash investors purchase distressed properties in their current condition, giving you a straightforward exit without the financial burden of engineering reports or structural fixes.

Benefits of Cash Sales for Distressed Properties

Cash buyers create faster, simpler solutions for homes with foundation issues. They purchase properties as-is without requiring expensive repairs before closing. You can complete these sales within days instead of waiting months for traditional closings.

No repair costs or realtor commissions apply when selling to cash buyers. This approach saves money and eliminates stress from lender rejections due to structural problems.

Additionally, cash buyers understand property conditions and expect honest disclosure about existing issues. For families needing quick resolution, cash sales provide immediate funds while maintaining transparency. This practical option helps homeowners move forward efficiently without prolonged market exposure.

No Repairs or Inspections Required

Cash buyers don’t require property inspections or repairs before purchase. You can sell homes with structural problems without fixing foundations or getting engineer reports.

Your family benefits from this approach during relocations, estate settlements, or foreclosure situations. These investors understand local property challenges and accept homes as-is.

Pennsylvania law still requires proper disclosures about known issues. However, you won’t need to complete any repairs. The process eliminates realtor fees and allows for quick closings. Most transactions finish within days rather than weeks or months. This speed gives families the flexibility they need during difficult transitions.

Faster Closing Timeline

Cash sales typically complete in 7-14 days versus 30-60 days for traditional sales. This quick process bypasses lengthy negotiations and repair delays common with foundation problems.

You can move on with your life faster without extended waiting periods. Fast property sales in Pennsylvania offer no appraisal contingencies that slow closings. Buyers provide immediate cash offers without financing approval requirements.

The process involves reduced paperwork and simpler documentation overall. Additionally, you can choose flexible closing dates that match your specific timeline needs.

There’s also no risk of buyers getting cold feet or deals falling through. Your family benefits from choosing speed and certainty instead of prolonged market exposure with foundation issues. As a result, you can address your changing needs more effectively.

Avoiding Realtor Fees and Commissions

You can avoid realtor fees by selling your home to cash buyers. This approach eliminates the typical 5-6% commission that reduces your sale proceeds.

Cash buyers work directly with you, removing the middleman completely. The direct sale process keeps more money in your pocket. You won’t pay listing fees, staging costs, or commission splits.

Furthermore, cash buyers often purchase homes with foundation problems as-is. This straightforward method offers financial relief when facing structural issues. Most importantly, you receive the full offer amount without deducting thousands for real estate agent services.

How to Sell Your House With Foundation Issues Fast?

Selling your house fast with foundation issues requires a strategic approach that balances transparency with speed. You’ll need to accurately assess your foundation’s condition, price competitively based on repair costs, and connect with qualified cash buyers who specialize in as-is purchases.

Assessing the Extent of Your Foundation Problems

You need a professional evaluation to determine how serious your foundation damage is. A structural engineer can provide a detailed report. This report will guide your selling decisions. Your options depend on damage severity.

Hire a licensed structural engineer for a complete foundation inspection. Take clear photos of all cracks and problems. Meanwhile, gather any past inspection documents you have. Then collect repair quotes from at least three foundation specialists.

Look for water issues around your foundation. Drainage problems often cause foundation damage. Furthermore, check if damage is spreading or stable. Understanding this helps you decide between repairing or selling as-is.

Pricing Your House Appropriately

Set your foundation-damaged home 10-15% below market value to attract buyers. Honest pricing acknowledges the property’s condition while creating interest from potential purchasers.

Foundation damage typically reduces property value by 10-15% compared to similar undamaged homes. You should expect further price reductions during negotiations.

Be transparent about repair costs by providing engineering reports and estimates. This honesty builds trust with buyers and protects you from future legal issues.

Furthermore, clear documentation helps buyers secure financing or plan their renovation budget. Cash investors often purchase damaged homes quickly, though at deeper discounts.

Investors typically expect 20-30% below market value for as-is properties with foundation issues. Nevertheless, competitive pricing speeds up your sale and demonstrates good faith to all parties involved.

Finding Qualified Cash Buyers

Cash buyers for damaged foundation homes exist in Pennsylvania. You must verify their credentials before accepting offers. Request proof of funds to ensure they can actually purchase your property.

Compare at least three cash buyer proposals to get the best deal. Pennsylvania law requires cash buyers to disclose all terms in writing. Legitimate investors have positive reviews and good BBB ratings.

Ask about their typical closing timeline, which should be under two weeks. Most foundation-focused buyers waive inspection contingencies entirely. This advantage eliminates repair negotiations and speeds up sales. These investors specialize in structural problems other buyers avoid.

Preparing Required Documentation

Collect essential paperwork before listing your home with foundation issues. Start with Pennsylvania’s mandatory Seller’s Property Disclosure Statement that details all known structural defects.

Gather engineering reports, repair invoices, and contractor estimates for any completed fixes. These documents build buyer confidence and provide legal protection.

Additionally, include drainage assessments, permits, and warranty information if available. Pennsylvania law requires sellers to disclose all known material defects.

Complete documentation reduces negotiation delays and speeds up closing, especially with cash buyers. Well-organized records demonstrate transparency and ethical practices. They help potential buyers make informed decisions about properties with structural concerns.

Navigating the Closing Process

To close a property sale smoothly, handle title issues and lien releases early. Complete your Seller’s Property Disclosure Statement with all foundation problems clearly listed.

Work with your title company to clear any liens before closing day arrives. Provide all repair records to buyers, including engineering reports and contractor bills.

Let buyers do a final walkthrough to check the property meets their expectations. This prevents last-minute disputes and builds trust.

Cash buyers typically complete closings in just 7-14 days with fewer conditions than traditional buyers.

Furthermore, having paperwork organized and ready speeds up the entire process. The closing will proceed much faster when everyone knows what to expect.

Who Buys Houses With Foundation Issues in Pennsylvania?

You’ll find three main types of buyers actively seeking Pennsylvania homes with foundation problems: cash home buyers and investors who specialize in distressed properties, real estate investment companies with ready capital, and fix-and-flip contractors looking for their next project.

These buyers won’t demand you make costly repairs before closing—they’ll purchase your home as-is and handle the foundation work themselves. Understanding what each buyer type offers helps you choose the fastest path to selling and moving on.

Cash Home Buyers and Investors

Real estate investors and cash home buyers in Pennsylvania purchase homes with foundation problems. They offer as-is purchases without requiring repairs. These investors close quickly, typically in 7-14 days.

No financing contingencies or loan delays come with cash offers. They waive inspections, which prevents deal-breaking objections. You can avoid realtor commissions when selling to them.

These buyers calculate foundation repair costs beforehand. They adjust their offers accordingly. This approach provides certainty when you need to sell quickly. Most traditional buyers avoid properties with structural issues.

Real Estate Investment Companies

Three main types of real estate investment companies buy houses with foundation issues in Pennsylvania: iBuyers, local cash buying firms, and property wholesalers.

iBuyers make instant offers using automated systems but often avoid homes with major structural problems. Local cash buying firms offer the best option for quick foundation problem sales. These companies specialize in damaged properties and can close deals within two weeks. As a result, you won’t face lengthy financing delays or repair negotiations.

Property wholesalers serve as middlemen between sellers and investor networks. For homeowners needing a fast solution, each option provides a streamlined alternative to traditional sales. However, local cash buyers typically offer the most direct path for homes with serious foundation damage.

Fix-and-Flip Contractors

Contractors who specialize in fixing damaged houses can benefit real estate investors significantly. They transform rundown properties into profitable assets through expert renovations.

These professionals handle all repair aspects, from foundation issues to cosmetic updates. Most importantly, skilled contractors complete work efficiently, allowing faster property flips. Investors typically see 15-30% returns on properties renovated by experienced contractors. The right team reduces holding costs and maximizes profit margins.

Quality contractors also understand local building codes and permit requirements. This expertise prevents costly mistakes and delays in the renovation process.

Ready to Sell Your Foundation-Damaged House to Pezon Properties?

You can sell your foundation-damaged house to Pezon Properties quickly and without repairs. We buy distressed homes in Pennsylvania as-is, offering fair cash deals. You won’t need to fix expensive foundation issues or wait through lengthy listings.

Our process removes common selling obstacles. We close transactions within days rather than months. No realtor commissions apply when you work with us. The straightforward approach includes full disclosure compliance without inspection contingencies.

Contact us today for a no-obligation evaluation. We’ll assess your property with compassion and understanding. Our solutions align with your timeline and financial needs.

A Little About Pezon Properties

Pezon Properties is a local, family-owned home buying business that helps homeowners sell their properties quickly and easily without the stress of selling the traditional way.

We simplify the home selling process and eliminate the hassles that come with selling your home. You are provided with solutions, convenience, and a great customer experience. We are easy to work with and do fair, win-win deals.

We are not flippers or wholesalers looking to make a quick profit. We are from the Lehigh Valley and invest back into the community to make it a better place for us all to live. We have been working directly with our neighbors to buy homes since 2014.

Whether you are

tired of being a landlord, inherited a property that you do not want, are facing divorce or financial issues, or want to sell quickly without the headaches, reach out to us today and we will help you in any way we can.

484-484-0971.