Preventing Bankruptcy: How Cash Sales Can Provide a Lifeline

Cash sales offer a lifeline for businesses facing financial distress, potentially preventing bankruptcy by injecting immediate liquidity into the company.

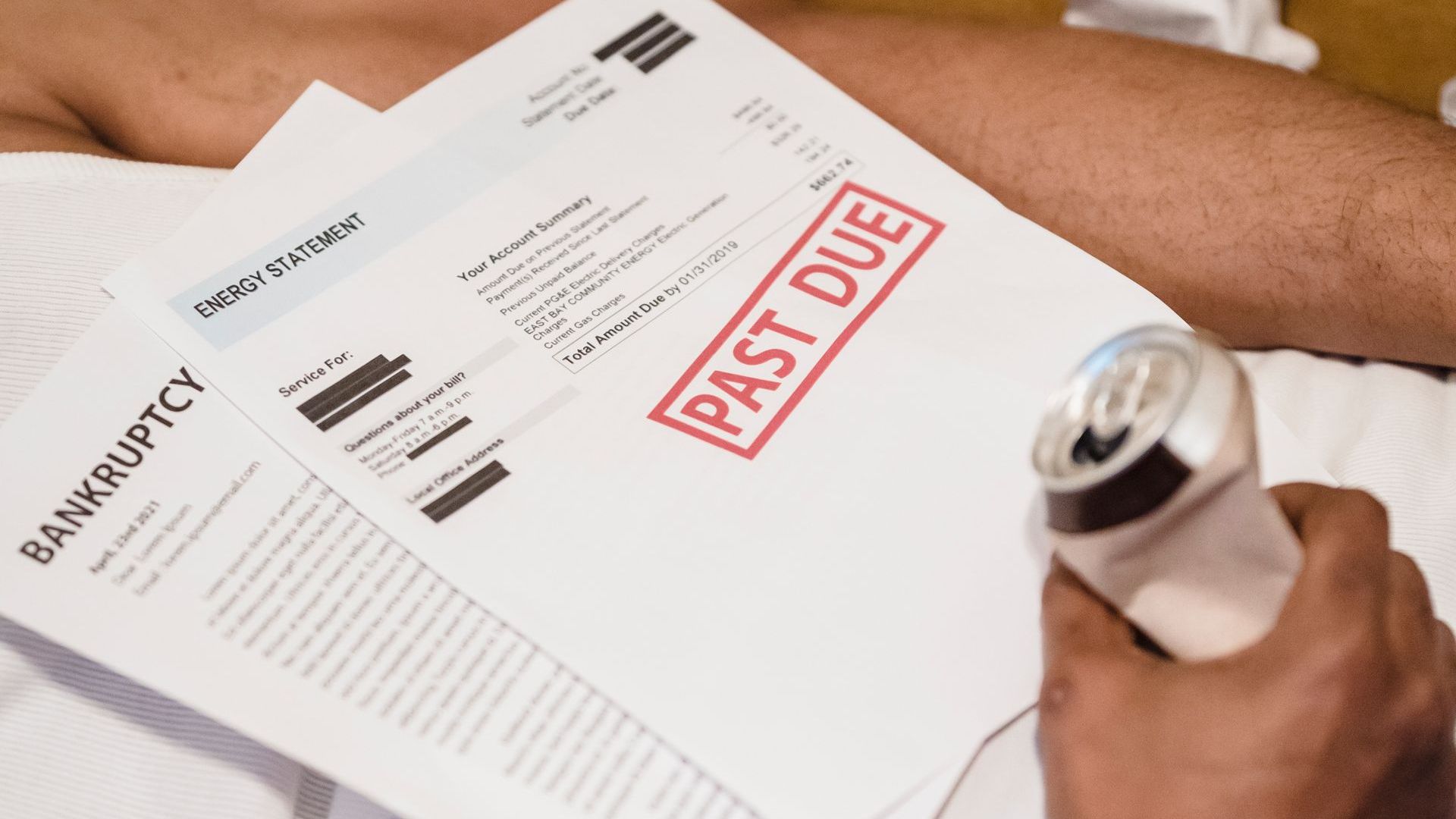

Individuals contemplating bankruptcy frequently seek methods to reduce their financial pressures and protect their belongings. For Pennsylvania homeowners facing financial difficulties, the thought of bankruptcy might be terrifying. Despite the problems, there is one lifeline that can save homeowners from bankruptcy: cash sales. In this detailed study, we will look at the mechanisms of cash sales, their benefits, and how they might be a feasible approach for Pennsylvania homeowners to avoid bankruptcy.

Bankruptcy has long had a stigma in the U.S. People who file for bankruptcy protection have been stereotyped as irresponsible, unethical, or lazy. But many Americans find themselves facing bankruptcy due to an unexpected crisis, like job loss, a medical emergency, or divorce.

Bankruptcy is designed to give debtors a fresh start and provide relief from creditors. But filing for bankruptcy is a complex decision, and while it may be the best route for some, it's not ideal for every situation. (1)

Understanding Bankruptcies in Pennsylvania

Before getting into the intricacies of cash home buyer Wilkes-Barre transactions, it's important to understand the ramifications of bankruptcy in Pennsylvania. Bankruptcy is a legal process that allows individuals and organizations to remove or repay their obligations while protected by the bankruptcy court. In Pennsylvania, bankruptcy proceedings are normally filed under Chapter 7 or Chapter 13 of the Bankruptcy Code. Chapter 7 involves the liquidation of assets to repay creditors, whereas Chapter 13 involves the reorganization of debts using a court-approved repayment plan.

The Consequences of Bankruptcy

While bankruptcy provides a fresh start for those drowning in debt, it also has serious consequences. One of the most significant repercussions of bankruptcy is the influence on creditworthiness. A bankruptcy filing can stay on a person's credit report for up to 10 years, making it difficult to get credit cards, loans, or lower interest rates in the future. Furthermore, bankruptcy may require the sale of valued assets, such as homes, to meet creditors' claims. For Pennsylvania homeowners, the possibility of losing their homes through bankruptcy can be very upsetting.

The Role of Cash Sales

Amid the prospect of bankruptcy, sell property for cash Wilkes-Barre emerge as an appealing option for homeowners looking to secure their assets and reduce their financial responsibilities. A cash sale is when you sell a property straight to a buyer without financing or mortgage approval. Unlike traditional real estate purchases, which frequently include lengthy talks and complex financing arrangements, cash sales provide a more efficient process with shorter timescales.

Benefits of Cash Sales

Cash sales are an appealing option for Pennsylvania homeowners facing bankruptcy due to a number of significant perks. First, cash sales minimize the uncertainties and delays that come with regular real estate transactions. Cash buyers don't have to wait for mortgage approvals or deal with the complications of financing because they have the funds ready right away. This expedited process allows homeowners to promptly liquidate their possessions and obtain much-needed cash to meet their financial obligations.

Second, buy my house fast for cash Wilkes-Barre provides more freedom and control over the terms of the transaction. Unlike traditional buyers who may want major repairs or concessions, cash buyers are frequently ready to purchase homes in their current state. This flexibility enables homeowners to sell their properties "as-is," eliminating the need for expensive repairs or modifications. Furthermore, cash purchasers may be more flexible when it comes to closing dates, giving homeowners the option to choose the terms that best meet their needs.

Furthermore, cash sales reduce the likelihood of the transaction falling through due to finance concerns or appraisal inconsistencies. Because cash buyers do not rely on external financing, there is a greater likelihood of closing, giving homeowners peace of mind and stability during a difficult period. Furthermore, cash sales often have fewer contingencies and contractual commitments, which reduces the possibility of issues or conflicts during the closing process.

Implementing a Cash Sales Strategy

For Pennsylvania homeowners considering a cash home buyer Scranton to avoid bankruptcy, it's critical to approach the process intelligently. The steps below can assist homeowners to manage the cash-selling process effectively:

- Assessing the Property: Start by determining the property's condition and market worth. Consider organizing a professional appraisal or inspection to ascertain an accurate assessment and uncover any potential flaws that could jeopardize the transaction.

- Researching Cash Buyers: Spend some time looking into trustworthy cash buyers or real estate investment organizations in Pennsylvania. Seek out experienced buyers with a track record of executing transactions efficiently and responsibly.

- Negotiating Terms: Once you've discovered possible cash purchasers, negotiate the terms of the sale. Be open about your financial condition and ambitions, and seek mutually beneficial terms that correspond with them.

- Finalizing the Sale: Once an agreement has been reached, work with the buyer to complete the necessary documentation and coordinate the closing procedure. To guarantee a seamless transaction, carefully check all paperwork and consult with legal or financial professionals as required.

- Addressing Financial commitments: Use the cash sale profits to pay off any outstanding debts, mortgage payments, or other financial obligations that may be causing you financial trouble. Consider getting professional financial counsel to create a complete plan for managing your money and recovering your financial health.

Conclusion

In conclusion, cash sales provide a lifeline for Pennsylvania homeowners facing bankruptcy. Cash sales allow homeowners to rapidly liquidate their assets, receive much-needed cash, and avoid the negative consequences of bankruptcy. With careful planning and effective execution, homeowners can use cash sales to protect their assets, reduce financial responsibilities, and pave the way for a better financial future. If you're a homeowner in Pennsylvania experiencing financial difficulties, considering a cash sale could be the key to achieving stability and peace of mind during difficult times.

However, it is important to remember that while cash sales can bring temporary comfort, they may not be a long-term solution to underlying financial issues. To secure long-term profitability and avoid repeated crises, firms must address the underlying reasons for financial distress, such as declining revenues, inefficient operations, or high costs. Businesses can also examine ways to diversify revenue streams, improve efficiency, and strengthen client relationships in order to develop resilience against future financial crises.

Give us a call anytime at 484-484-0971 or fill out this quick form to get started today!

Get A Fair Cash Offer On Your House

About the author

Mathew Pezon

Mathew Pezon is the founder and CEO of Pezon Properties, a cash home buying company located in Lehigh Valley, Pennsylvania. With several years of experience in the real estate industry, Mathew has become a specialist in helping homeowners sell their properties quickly and efficiently. He takes pride in providing a hassle-free, transparent, and fair home buying experience to his clients. Mathew is also an active member of his local community and is passionate about giving back. Through his company, he has contributed to various charities and causes.